Your CEO just forwarded another article about what Competitor X is doing. Again. Now there's a Slack thread dissecting their latest feature launch, their new positioning, and whether you need to "respond."

Here's what happens next: Someone gets tasked with "competitive research" (this is probably you). So, you put your high-priority work on hold and disappear for three days and emerge with bloodshot eyes and a 47-slide deck that took forever to build and answers none of the questions anyone actually cared about.

Sound familiar?

The Problem with Traditional Competitive Audits

Most competitive audits are expensive procrastination disguised as strategy work. Teams spend weeks gathering random competitor intel and cobbling it together into presentations that sit in folders, changing absolutely nothing.

Not all competitive audits are bad. When you're dissecting or redoing a specific strategy around thought leadership, SEO, or social outreach, that research might be worth the effort. But the competitive audits that kill productivity are the reactionary ones - the fire drills triggered when companies are under pressure, a new competitor enters the market, or an industry report drops and your position slides.

These reactive audits skip the most important step: What question are we trying to answer?

Instead of "go research the competition," the questions that drive competitive audits should be specific questions like:

- Are they pricing lower than us?

- What channels are they using that we're not?

- How are they positioned against us in the market?

Without clear questions, you end up with expensive busy work that pulls you away from what you should be doing.

The Copy-Paste Trap

Here's another problem: when everyone's copying each other, there's no real competitive advantage. Look at any B2B industry and you'll see the same phenomenon - every SaaS security company bragging about their Gartner Magic Quadrant placement, every homepage claiming to be "AI-powered" with "seamless integration" and "enterprise-grade" everything.

When everyone's a "leader," nobody is. It's just noise.

But here's a question you really need to ask: How do you know what your competitors are doing is actually working?

You're essentially copying off someone else's test without knowing if they got the right answers. Yikes.

This is where competitive audits go sideways and reinforce the "sea of same" everyone's trying to battle against. It's a terrible battle between FOMO and competitive differentiation, and FOMO usually wins.

A Better Framework: The 5 P's

Instead of random data gathering, try a structured approach that takes 15 minutes and gives you actionable intel. This framework covers five key areas:

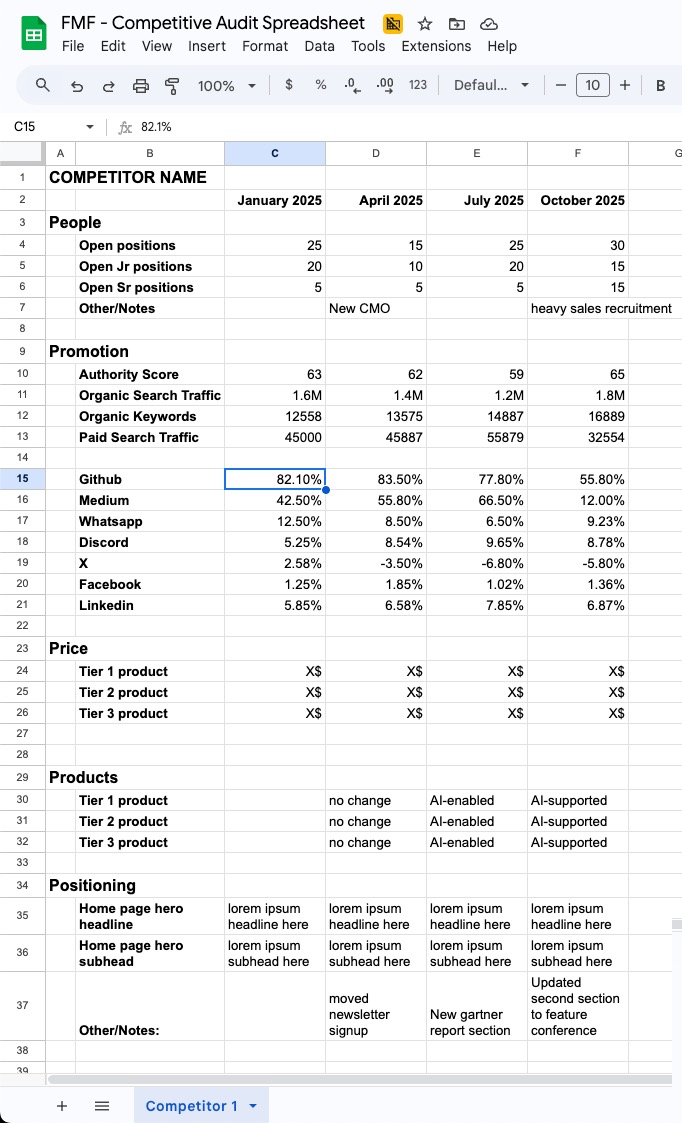

1. People

Do a quick LinkedIn check to see who they're hiring, who left, who got promoted. LinkedIn search is underrated - you can find amazing information just by searching for the company name in posts.

Look for patterns:

- Are they mostly hiring junior people or bringing in senior leadership?

- If they brought in a new CMO or head of sales, expect strategy changes

- If they're hiring multiple engineers in a specific area (mobile, AI), that signals their product roadmap

- Tons of customer success hires might indicate retention issues

- Enterprise sales reps suggest they're moving upmarket

Set up Google Alerts and Talkwalker alerts for company mentions and key executives.

2. Promotion

Focus on channels and activity at a high level:

- Use SEMRush (free version) to check their search strategy

- Review Facebook, Meta, and LinkedIn ad libraries for current campaigns

- Use SparkToro to see which channels their audience uses regularly

- Subscribe to their newsletters with a separate Gmail account to track messaging progression

- Do a quick AI search to check their SEO visibility

3. Price

Take screenshots of their pricing if available and track changes over time. Note if they're raising prices, offering discounts, or changing packaging. This tells you about their growth strategy and market confidence.

If pricing isn't visible, note how they talk about their pricing and whether they anchor it against familiar alternatives.

4. Products

Make note of high-level services or products and how they're promoted. Look for new launches or discontinued items, and track which features get highlighted over time.

Remember: features can be copied, but true competitive differentiators come from what your paying customers say makes your product different.

5. Positioning

Look at their value proposition and how they position themselves to prospects. Take screenshots of their homepage, especially the hero section, and note changes over time.

The homepage is the hardest working page on any website, and the hero section has the heaviest lift. Changes here often signal strategic pivots or new target audiences.

Setting Up Your Competitive Dashboard

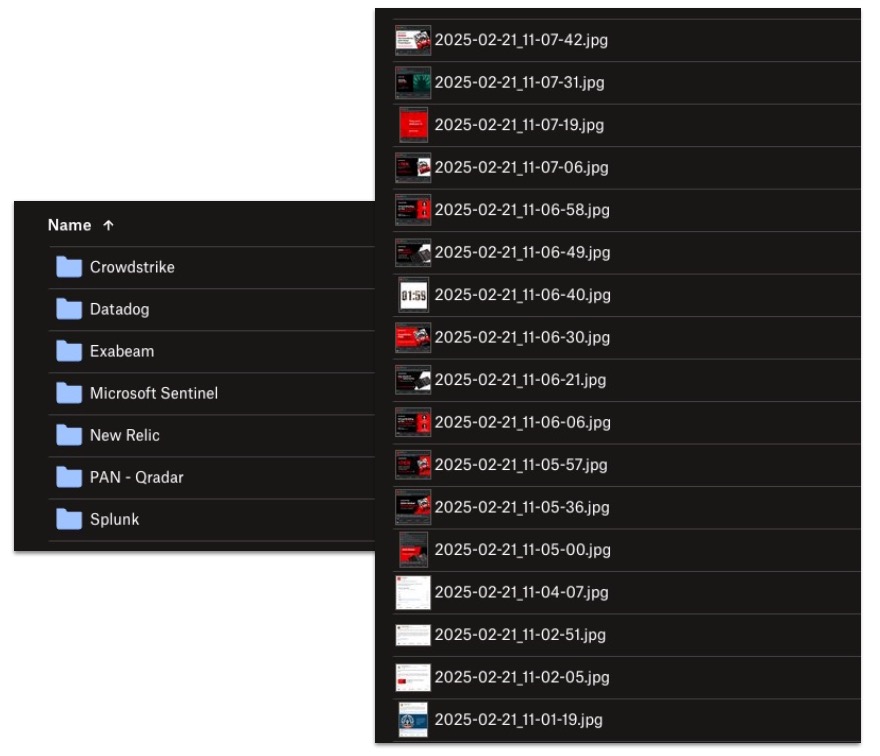

Use tools you already have - a simple spreadsheet and file folder work great. The first time takes about 20 minutes to establish baseline data. After that, monthly 15-minute updates are enough to track meaningful changes.

Take screenshots of everything and keep them in a swipe file for easy reference. You can use Google Sheets and Google Drive, or Excel and Dropbox - whatever you already pay for.

The "So What?" Test

For every change you notice, ask yourself "So what?" This is where data becomes insights:

- New CMO → Expect refreshed marketing strategy in 6-12 months

- 30% organic traffic increase → Updated content strategy or refined audience targeting

- Homepage messaging changes → New products, positioning shift, or strategic pivot

Look at patterns over time, not just immediate changes. If they're changing their hero section every quarter, that might indicate a promotion-heavy culture or ongoing positioning struggles.

Present Insights That Matter

When you need to brief executives, keep it simple with two sections per competitor:

- Here's what changed: New CMO at Competitor X; their organic traffic jumped 30%. They updated their homepage messaging twice this quarter.

- Here's what we should watch: Expect a new marketing strategy from this competitor. Monitor their content output for keyword changes and keep an eye on messaging shifts.

Your executive team gets actionable intel that answers their concerns, and you spent 15 minutes instead of three days. Everyone wins.

The Bottom Line on Competitive Audits

- Use cheap and free resources you don't need to learn.

- Fast updates tracking changes over time beat deep research run occasionally.

- Remember the 5 P's cover everything executives care about.

- Most importantly: stop copying your competitors. They probably have no idea what they're doing and are likely copying someone else too.

- Your competitive advantage isn't in your competition's blind spots - it's in the value your customers say they get from your product. Now go ask them what that is.

Need help figuring out what your real competitive differentiators are and how to operationalize them into your business?

We specialize in helping companies uncover the insights that drive actual growth - not just competitive theater. Contact us and we can help you turn customer feedback into your competitive advantage.